IDTechEx estimates the RFID industry will reach US$14 billion in 2023, up from US$12.8 billion in 2022. This market value encompasses various RFID form factors, including labels, cards, fobs, tags, scanners, software, and services for active and passive RFID technologies. Among these, the “Passive RFID Tags” segment stands out as the largest, comprising more than half of the total RFID market.

The UHF RFID market is predominantly driven by the retail sector, which accounts for 64% of the market share by tag volume and 72% of the market share by value. While nearly 24 billion RFID labels are expected to be used in retail apparel tagging by 2023, the total addressable market for retail apparel alone is around 80 billion tags per year, indicating ample growth opportunities.

The retail apparel sector has successfully adopted RFID technology due to the ecosystem’s maturity and availability of solution providers. In retail apparel applications, UHF RFID technology has also become widely adopted due to its low cost, enabling infrastructure, and other benefits, such as improved stock monitoring. Despite the retail sector’s dominance, other vertical markets, such as electronics, soft furnishings, and home appliances, are also expected to show strong growth in RFID tagging. Walmart’s mandate has been a significant driving factor in this regard.

Growth is anticipated in the supply chain and logistics industry, which accounts for 22% of the market share by tag volume and 14% of the market share by market value. The pandemic has also accelerated the adoption of UHF RFID technology, with increasing digitalisation across various industries and continued reduction in tag costs contributing to the growth of the UHF RFID market.

Various factors, including pandemic, cost reduction, and lighthouse projects demonstrating RFID technology’s benefits, are driving UHF RFID’s growth in the coming years. It is worth noting, however, that UHF reader networks are still primarily business tools, and smartphones are targeted at businesses rather than consumers.

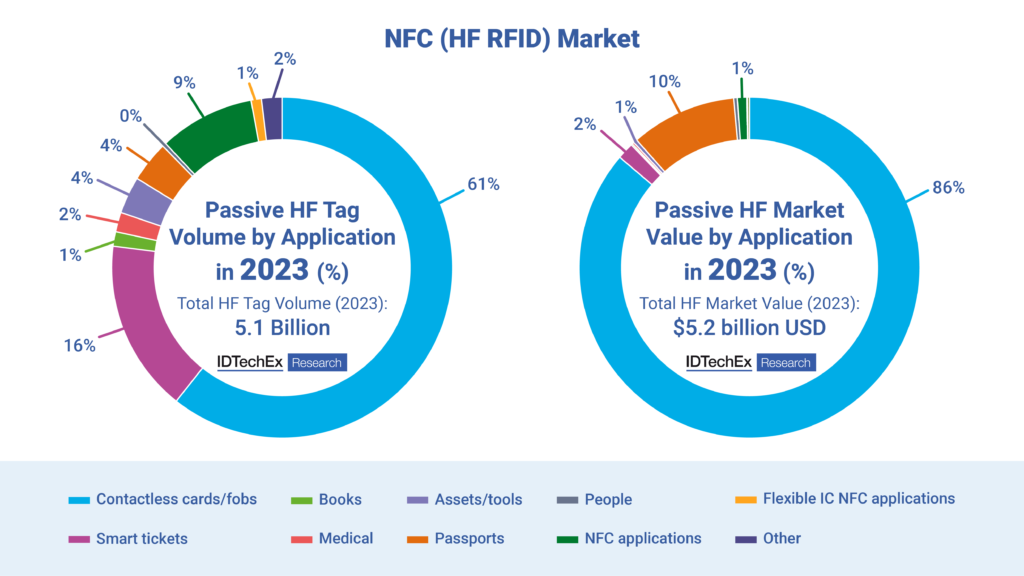

Access control, transit, and payments are all well established applications of HF RFID. The market value of HF tags is estimated at 5.2 billion dollars in 2023, equivalent to 5.1 billion HF tags sold. In spite of the smaller tag volume, the HF market value is larger than the UHF market value due to the higher HF average selling price (ASP). As emerging digital methods such as mobile payments and QR codes gain traction, contactless cards/fobs are expected to decline in the medium term. Passports are the second-largest market for HF tags. Although the total tag volume in this sector is not as high, the ASP is high, resulting in higher market value.

The number of NFC labels will grow to several hundred million in 2023. However, most are still relatively low-volume deployments across many projects, such as Bluetooth pairing, gaming, and smart packaging.

The RFID market is expanding, but it faces obstacles. Global supply chain problems and macroeconomic conditions are discussed in the article. There were supply chain issues in 2021 that have not yet been resolved. However, the negative consequences have reduced since then. According to IDTechEx, most firms believe the situation will improve by early next year. As a result of the economic downturn, some industries have reduced their purchases of RFID tags, especially in initiative projects, which could potentially slow the market’s growth. To ensure sustainable growth, the RFID industry must continue to address other challenges, including better education, regulation, ecosystem establishment, and cost reduction.

To find out more on the RFID market research report, click here: “RFID Forecasts, Players and Opportunities 2023-2033”